Connecting emerging fund managers with capital allocators in-person at SOCAP. Read on and submit your organization if you are an emerging fund manager who is attending SOCAP25 in October 2025.

funding

Closed on 10/22/2025, 6:59:59 AM

Founded: 2025

Founded: 2025Supporting regenerative entrepreneurs in acquiring & growing profitable small businesses.

Regenerative Capital Group (RCG) is a Canadian-based investment firm that invests in purpose-driven impact entrepreneurs, to acquire high potential, growth-stage SME businesses that can support a thriving and regenerative future for people and planet. RCG’s innovative investment model leverages the momentous opportunity created through the ‘Silver Tsunami’ decade of baby-boomer generation SME business owners retiring and without succession plans for their proven and profitable companies (900,000+ in Canada). In addition to 20 years of GP success in SME acquisitions, growth, and exits, the Fund utilizes the incredibly successful ‘Search Fund’ investment vehicle (35% IRR historical returns), and a Regenerative Value Creation strategy that aims to grow the overall health and wealth-building capacities of the stakeholder ecosystems that these proven businesses can reach. RCG creates Net-Positive systems impact by supporting the evolution of a business’ core purpose and value creation strategies to come into alignment with living systems principles and wider nested stakeholder and ecosystem needs, as a non-displaceable source of competitive advantage.

Operator-led fund investing in the future of learning and work

Brass Ring Ventures is an exited-operator-led fund investing in companies that are building technology to foster economic mobility through the future learning and work. Founded by Miriam Altman-Reyes (co-founder/CEO of Kinvolved, acq. By PowerSchool) and led by a team of General and Operating Partners who have led through six successful industry exits, the firm supports founders as advisors and fractional executives through BRV’s studio, helping them to “cross the chasm” to the next stage of growth and beyond.

.png&w=640&q=75) Founded: 2023

Founded: 2023Fintech and Impact focused VC Investor

Seed stage fintech for financial resilience

First checks into startups rethinking how we learn and grow

We invest the first check into startups rethinking how we learn

Founded: 2021

Founded: 2021The earliest institutional partner of choice for founders advancing social progress.

Fairbridge is a New York-based venture capital firm investing in early-stage companies bridging the gap between technological and social progress. Fairbridge was founded on a simple, but powerful bet: that investing for social progress is rapidly emerging and will become a distinct market segment in venture capital: intellectually rigorous, culturally resonant, and every bit as profitable as any other categories of the asset class. Rapid technological advancement is driving mission-driven founders to reimagine outdated business models and to invent of new ones to create markets that eliminate access gaps and deliver enduring solutions to underserved billions. Fairbridge’s mission is to be the earliest partner of choice for exceptional founders addressing the largest discrepancies – health, wealth, and planet.

Investing in the future of commerce and the future of work

Capitalize VC is a Chicago-based firm investing in the $32.5 trillion global commerce industry and its connection to the creator economy. The firm invests in B2B commerce-enablement software companies at the pre-seed that are solving critical problems for retailers, brands, creators, and their supply chains as they navigate a rapidly shifting commerce and creator landscape.

Founded: 2025

Founded: 2025Unleashing Innovation in the World's Largest Overlooked Market

Adaptation Ventures is the first angel group fund in the US for early-stage disability and accessible tech startups. It is led by founders with highly successful startup exits and deep disability-tech expertise, world-class partnerships, global operations backgrounds, lived experience with disabilities, and national angel investment leadership.

Founded: 2019

Founded: 2019Growth-stage private equity investor focused on tech-enabled education and human capital development

Lumos Capital Group is an investment firm focused on the global education and human capital development market. Lumos invests in growth-stage companies that are bringing transformative products and services to improve the quality of and access to education and training, from early childhood education to workforce development. Lumos typically invests $10 to $30 million in minority or majority recap transactions and is an active partner to its portfolio companies, bringing its global network of advisors and partners as well as sector-focused strategic experience to help companies grow. The firm was founded in 2019 and is supported by blue chip institutional investors.

Founded: 2007

Founded: 2007An impact VC fund supporting entrepreneurs who share our vision for a more equitable world

SustainVC, headquartered in Philadelphia, is a venture capital firm that believes business can be a force for good. For over 15 years, SustainVC’s team has partnered with innovative entrepreneurs to advance a vision of a sustainable, equitable, and healthier world. Our goal is to achieve both measurable social and environmental impact and market-rate financial returns. The SustainVC portfolio includes nearly 50 high-impact, high-growth companies in the areas of ‘Access & Opportunity’ and ‘Climate & Sustainability.’ We are seeking connections with like-minded investors who want to align their investments with their values. To date, SustainVC has raised and deployed two previous funds and is in the process of launching its third fund, SustainVC Impact Fund III.

Founded: 1997

Founded: 1997Accelerating entrepreneurship to end global poverty and protect the planet.

Miller Center Capital is the impact investing arm of Miller Center for Global Impact, dedicated to funding entrepreneurs fighting to end global poverty. Together with our fund manager, Beneficial Returns, Miller Center Capital strategically deploys flexible, entrepreneur-centric debt capital designed to support social enterprises across their growth journey. By investing in members of Miller Center’s enterprise community, particularly those that are women-led and locally led, our mandate bridges the “valley of death” in early-stage funding. With a global footprint across emerging markets and a goal to catalyze $200 million for social entrepreneurs by 2030, Miller Center Capital exemplifies venture philanthropy at scale.

Founded: 2021

Founded: 2021Nomadic Venture Partners invests in cutting-edge software and hardtech that decarbonize mining, manufacturing, and heavy transportation, with a focus on building a sustainable, resilient future.

Venture Capital fund investing in Latinx / diverse entrepreneurs for alpha & impact.

VamosVentures Fund I is a $50M fund deployed against 33 US-based companies across our four verticals - Health, Financial, Sustainability and Future-of-Work. 100% of our companies are led by diverse teams, 88% led by Latinx founders and 48% led by women. Fund I is generating positive investment indicators and we expect it to be a successful investment for our LPs. Fund II is a $100M fund and consistent with Fund I. Fund II has raised 75% of target and will continue to raise through May 1, 2026. Fund II has already made its first two investments and we are very excited about their prospects. VamosVentures is building a platform for growth, alpha, and impact. Headquartered in Los Angeles with offices in New York and Austin, the team is now 6 full-time professionals, 100% diverse.

Founded: 2014

Founded: 2014Project Equity is a national leader in the movement to expand employee ownership.

We are a nonprofit organization with a variety of programs and the Employee Ownership Catalyst Fund. Our programs both support direct services to businesses in transitioning to employee ownership and contribute to field building and normalizing employee ownership as a business succession strategy.

Founded: 2021

Founded: 2021South African based Growth Stage Impact

Tshiamo Impact Partners is an impact advisory and boutique asset management firm. Tshiamo Impact is currently fundraising for the Tshiamo Gender Lens Impact Fund that is closing the funding and gender gap for small and growing businesses that have been overlooked by traditional finance. The Tshiamo Gender Lens Impact Fund is looking to raise R400million (and has already secured R50 Million in commitments) that will invest across key sectors that are primed to be job accretive, namely: manufacturing, social services and infrastructure (education & healthcare), technology, and agro-processing.

Founded: 2021

Founded: 2021Impact investor financing the broadband marginalized communities need to thrive.

Connect Humanity is a non-profit impact fund working to change that, combining tailored investments, strategic advice, and technical guidance so that everyone can connect to fast, affordable, reliable internet access. Traditional telecom operators have not and will not solve this problem. Current government efforts, though welcome, will not get the job done. A growing ecosystem of community networks, municipal providers, and small businesses are connecting the unconnected — but lack access to the kinds of capital they need. By investing in the community-focused ISPs best placed to close the digital divide, we expand fast, affordable broadband in underserved communities.

.png&w=640&q=75) Founded: 2023

Founded: 2023Early stage venture capital firm investing to shape a more beautiful future.

VC 414 is an early stage venture capital firm that invests in underdogs and outsiders who are shaping a more beautiful future - one defined by human vitality, economic abundance, and resilient communities.

Founded:

Founded:  Founded: 2010

Founded: 2010The Great Breakthrough

Based in Seoul, Impact Square is an impact accelerator in Asia, dedicated to impact business making a great breakthrough against fundamental dilemma between impact and economic value of our world. Founded in 2010, we recognized that social and economic value, often seen in conflict, can actually serve as sources of mutual growth and innovation in this era. We collaborate with partners across various fields, including social ventures, impact investing, social value assessment, ESG, nonprofit startups, and social impact bonds (SIB) etc. The company’s business mainly comprises three areas: Accelerating, Investing, Impact measurement and research. ◾We provide professional accelerating program to impact startups to grow their impact by scaling their business. ◾We are operating 5 impact funds, and open to diverse themes for each funds including a wide range of environmental issues, employment, education, elderly, disabilities, etc. ◾Our research lab Impactology dedicated to impact measurement and management(IMM) forms the basis of our approach.

Founded: 2018

Founded: 2018Beta Boom invests in pre-seed and seed startups solving meaningful problems for businesses and people.

Beta Boom is a pre-seed and seed venture firm focused on investing in software startups led by founders who are pattern breakers—those who don’t fit the typical Silicon Valley profile, building in digital health, the future of work, and core industries that drive the economy.

Founded: 2025

Founded: 2025Impact Investing for a Democratic and Just Economy

AllHold Capital is a mission-driven investment fund designed to enable the equitable transition of business and real estate ownership to workers in low- and moderate-income (LMI) communities. We utilize a single, perpetual trust structure to hold both business operations and commercial property, creating good jobs, long-term benefits, and stable, community-rooted wealth. Each year, thousands of essential small businesses in LMI neighborhoods face closure due to owner retirement or displacement. AllHold Capital provides a solution: we facilitate the transition of these businesses and their real estate into a single, employee-owned trust. This integrated structure protects location permanence, prevents gentrification-driven loss, and embeds wealth with workers—not outside investors. By directing control and profits to workers and ensuring permanence of location, AllHold offers durable, replicable infrastructure for economic justice. Our inaugural fund is a $10 million, 10-year fund that invests in profitable small businesses ($500K–$5M valuation) with fewer than 40 employees and associated real estate. We use a blended capital approach—bringing together seller financing, our own catalytic capital, and senior debt from CDFIs and banks. Our investments support the transition to Employee Ownership Trusts (EOTs) that preserve place-based value. We believe this model builds long-term economic stability, prevents displacement, and turns small business succession into a community wealth-building opportunity.

Founded: 2025

Founded: 2025Innovative Growth Capital For Small Businesses

National lender serving BIPOC, veteran, LGBTQ+, & women-owned businesses, as well as businesses in LMI zones & those committed to diverse hiring practices. Helping accelerate business growth through our Revenue-Based Funding products & Advisory Services. Together, we can create more jobs, increase your revenues and bottom line, and provide more growth capital to help your business. We’re backed by the nation’s top philanthropic organizations, so that we can fund you with the right capital.

Founded: 2025

Founded: 2025Where others see ‘niche,’ we see generational opportunity—because kids are the future.

PEDIATRIC PARADOX: Children make up 25% of the population but receive less than 1% of healthcare investment. Decades of underinvestment have created a pediatric healthcare crisis. 95% of FDA products are NOT approved for pediatric use. The result? U.S. pediatric outcomes rank near the bottom among OECD nations. Today, 1 in 2 kids lives with a chronic condition that extends into adulthood. And with 1 in 12 pregnant women lacking access to care, U.S. maternal and infant mortality rates are 93% and 30% higher than OECD peers. We leverage our expertise (✓ Science ✓ Clinical ✓ Growth ✓ Exit) to back founders solving the most urgent pediatric and maternal health challenges—starting with pediatric chronic childhood conditions and perinatal/maternal health. We invest in high-return, high-impact solutions for pediatric and maternal health—backing founders uniquely positioned to close critical gaps. Our Impact: Kids: US OECD health outcomes from worst best Adults: Improved longevity & fewer chronic conditions Communities: Better school attendance & workforce participation Economy: Higher productivity & lower healthcare costs

Founded: 2019

Founded: 2019Kiva Capital supports underserved communities with impact-first capital.

Established in 2019 as a wholly-owned subsidiary of the nonprofit kiva.org, Kiva Capital envisions a financially inclusive world where everyone, regardless of socioeconomic status, has access to capital and the opportunities that come with it. By leveraging Kiva’s unique global network of financial services providers and social enterprises, Kiva Capital facilitates deep financial inclusion impact alongside conscientious financial stewardship. Through thematically focused impact funds, Kiva Capital provides debt investments to mission-aligned financial service providers and social enterprises supporting underserved populations. Actively addressing challenges faced by communities often left out of traditional markets, Kiva Capital particularly focuses on reaching refugees, women, and climate-threatened communities.

Founded: 2019

Founded: 2019We invest in bold innovators solving the biggest challenges in the Food System

FTW Ventures is an early-stage venture fund investing time, money and a network in Food & Agriculture Tech startups to build a better Food System.

Founded: 2016

Founded: 2016The Alliance is a 501(c)(3) nonprofit organization offering no-cost capacity-building support to tribes through four key pillars – built on a strong foundation of Native American culture and values.

The Alliance is a 501(c)(3) nonprofit organization founded in 2016 by Chéri Smith (Mi’kmaq), a clean energy veteran with more than 25 years of experience leading both public and private renewable energy development, policy, finance, workforce, and education initiatives. Our highly qualified in-house team includes Indigenous and non-Indigenous subject matter experts in engineering, finance, law, installation, operations and maintenance, workforce development, and more. The mission of the Alliance is to support the self-determined efforts of Native American Tribes and Alaska Native Villages to transition toward clean energy systems – as a means to mitigate climate change, diminish poverty, and create thriving economies while protecting Mother Earth for future generations.

Founded: 2019

Founded: 2019Bringing local communities as shareholders in renewable energy projects.

Meliquina structures equity partnerships with investors and local communities to develop and build 250 MW of solar and wind projects. We are designing ground-breaking financial solutions to solve communities' lack of access to capital to meaningfully participate in the energy transition as equity partners.

Founded: 2021

Founded: 2021We are an Indigenous-led fund manager that puts Indigenous communities first. We use outcomes finance to fund meaningful solutions.

Indigenous communities have been clear: “We know what works—we just need funding that respects our ways.” Raven Outcomes was created to meet that need. For too long, funding has been top-down, hard to access, and not focused on real results. Raven Outcomes changes that by putting Indigenous communities in the lead and tying funding to what works. We are the first Indigenous-led outcomes fund in Canada—and the only one of our kind in the world. We work with communities to support solutions that create lasting change, from healthier homes to clean energy, better health, and good jobs.

Founded: 2018

Founded: 2018We are a non-profit organization

The Dharma Karma Foundation has three pillars: climate, ed tech and equity. Within these 3 focus areas, the Foundation seeks to create a positive impact for communities by elevating carbon management and education solutions.

Founded: 2024

Founded: 2024We are impact focused early-stage venture fund investing in economic mobility!

JFFVentures is an early-stage venture fund backing tech-enabled solutions that drive economic mobility for low- to middle-income workers. Spun out of Jobs for the Future (JFF), a national nonprofit with a 40-year track record in workforce and education systems change, JFFVentures combines strategic capital with deep ecosystem access. We’ve raised $25M toward our Economic Mobility Fund I, with backing from mission-aligned institutions including the Michael & Susan Dell Foundation, Annie E. Casey Foundation, Strada Education, Samvid Ventures, and World Education Services. Our portfolio includes AI-native platforms supporting adult learners, immigrant workers, solopreneurs, and small business owners, each aligned with our vision of a more inclusive, equitable economy.

Founded: 2021

Founded: 2021Women-led Impact VC Firm investing in health technologies with a gender and climate lens

Cross-Border Impact Ventures (CBIV) is an Impact Venture Capital firm that invests in early-growth stage health technology companies commercializing medical devices, diagnostics, therapeutics, and digital health innovations and leveraging cutting-edge technologies like Artificial Intelligence and Machine Learning. All innovations CBIV finances are relevant to women, children, and adolescent health and are located in North America and Europe with the ability to scale technologies to Emerging Markets. CBIV's Women’s and Children’s Health Technology Fund II will invest in Series A/B commercial-stage companies that address the healthcare needs of women and children inclusively and globally with emphasis on healthcare areas where there are significant disparities related to the gender, age, race, wealth, or geography, including health conditions that are expected to become more prevalent or severe with climate change.

Founded: 2017

Founded: 2017Impact-first agrifood systems investor

Ground Up Investing (GUI) was established in 2017 by Corus International organization Lutheran World Relief to augment and transform traditional development approaches. GUI is an impact first investor that provides enterprises with patient, partnership-oriented capital and technical assistance. We invest at the early stage and look for ambitious founders who are challenging the status quo in developing and frontier markets. Our investments improve the economic prospects for hardworking families and transform the ecological health and resilience of their farms and communities. Our capital partners include philanthropists, institutional funders, and foundations.

Founded: 2021

Founded: 2021Catalyze is a platform for capital entrepreneurs - innovative and underrepresented investment fund managers

Launched in early 2022, Catalyze supports Capital Entrepreneurs—underrepresented & innovative investors—improving the flow of capital to overlooked businesses. Our national platform provides Capital Entrepreneurs with the capital, capacity building, and community they need to build enduring firms. Catalyze recently launched the GP Runway Fund, anchored by Spring Point Partners, Gary Community Ventures and Blue Haven Initiative, to provide flexible working capital loans for Capital Entrepreneurs raising Funds 1-3 across private markets. You can learn more about the Fund here. The Catalyze team collectively has 50 years of fund investment, diligence, and operational experience from Cambridge Associates, Goldman Sachs, Kauffman Foundation, and Blueprint Local. Beyond our anchor investors, we are proud to be supported by amazing partners like JPMorgan Chase, Wells Fargo, MacArthur Foundation, and Skoll Foundation.

Ownify's fractional ownership platform partners investors with missing middle homebuyers.

Ownify's fractional ownership platform partners investors with missing middle homebuyers. With Ownify, homebuyers and investors together reap the collective benefits of building equity, creating stability, and investing in the health of local communities for years to come. Since inception, our customers have saved an average of $29k in down payment and over $300 / mo in housing costs. For our "Ownis", Ownify offers a low down payment of 2%, a powerful cash offer to compete against corporate buyers, no unforeseen costs & surprises, and evergreen equity in their home.

Founded: 2014

Founded: 2014Sunwealth is a clean energy investment firm on a mission to change who benefits from renewable energy by changing the way we invest in it.

Sunwealth invests in a better energy future by financing and developing solar and storage projects that benefit a broad range of communities through clean power, carbon reduction, cost savings, and job creation. We partner with skilled local solar and storage installers, community organizations and local businesses, and investors to change who benefits from renewable energy by changing the way we invest in it. Sunwealth partners with individuals, foundations, family offices, nonprofit organizations, intermediaries, and corporations to invest in portfolios of community-based solar and storage projects. With Sunwealth, our investors put their money directly to work in community-based solar and storage projects that benefit people and the planet. Our innovative portfolio strategy provides businesses, municipalities, and community organizations with access to affordable clean energy while creating powerful social, environmental, and financial returns. Sunwealth is fundraising in the Solar Justice Fund (SJF), which we created to raise and deploy project capital that accelerates our mission. The fund strategy invests capital to safe harbor, construct, and provide permanent debt for impactful community-based solar projects. Every dollar invested in SJF goes to work securing local investment flows and locking in the impact of energy savings in communities.

Founded: 2021

Founded: 2021An early stage VC firm empowering founders beyond capital

non sibi ventures seeks leading venture returns by applying value investing principles to our sourcing and selection process. We invest in seed and series A category defining U.S.-based startups in sectors where we have domain expertise: industrial tech, AI, and sustainability. Post-funding, we empower our founders by leveraging our formidable network and extensive experience. We are performance driven and intentional about impact

Founded: 1908

Founded: 1908Canada's largest non-profit community healthcare org and an impact investor

SE Health is a not-for-profit social enterprise and one of Canada’s largest and most trusted community healthcare organizations. For over 115 years, SE Health has been delivering compassionate care and innovative solutions to help Canadians live well, age well, and stay well at home and in community. Today, the organization operates across the continuum of care—providing home care, long-term care, assisted living, palliative and hospice care, as well as education and training through its accredited career college. Beyond care services, SE Health is a national thought leader and catalyst for innovation in health and wellbeing. Through its research institute, social impact programs, and SE Impact Ventures fund, the organization partners with and invests in communities, startups, and healthcare leaders to address some of the country’s most pressing challenges, from workforce shortages to aging populations to housing and health equity. Guided by its purpose of spreading hope and happiness, SE Health combines compassion, technology, and community to create lasting impact for Canadians of all ages.

Founded: 2021

Founded: 2021RFG Fund II invests in the most resilient, enterprising and often overlooked founders who are at the earliest stages of building companies that improve how we learn, work and live.

RFG is currently investing out of a $20M Fund I. We have made 20 investments across education, work, health and financial inclusion. RFG Fund II will invest $40M to $45M in the most resilient, enterprising and often overlooked founders who are at the earliest stages of building companies that improve how we learn, work and live. Stage / Round & Check Size / # of Investments: Pre-Seed: We will invest ~$500K in $1 - 2M rounds to buy 6 - 8% stakes. These deals will likely use SAFEs or convertible notes; the expected average post-money valuation cap is $8.5M. We plan to make 20 pre-seed investments. Seed: We will invest $1M in $2 - 4M rounds to buy 6 - 8% stakes. The deals will be a mix of SAFEs, convertibles and equity priced rounds; the expected average post-money valuation cap is $17M. We plan to make 15 pre-seed investments. Pacing and Holding Period: We will make 35 total investments; on average we’ll make seven (7) investments annually during the course of the five-year investment period. We plan to hold these investments for 5 to 10 years. Generally, we will hold positions until either: (a) an exit; (b) the company is within our MOIC forecast and there is a liquidation opportunity or (c) the company is projecting below our MOIC forecast and there is a viable liquidation opportunity. Investing across the United States: In Fund I 100% of our investments were in U.S. domiciled companies, with ~66% outside of major tech hubs (e.g., NY, SF, Boston). We anticipate a similar outcome in Fund II.

Founded: 2021

Founded: 2021Collective, collaborative, cooperative, economic liberation.

As a social enterprise, CoLIberate USA improves financial health through financial education, skill-building, and investment opportunities.

Founded: 2022

Founded: 2022We address the wealth gap via small business "asset" ownership in the US

We provide resources and capital to under-represented entrepreneurs to acquire and run existing small businesses

Founded: 2024

Founded: 2024Real Estate Fund with unequivocal advantages and broad community impact

I.Established Platform: $1.9B AUM, disciplined 35.1% LTV*, 50+ vertically integrated team in private equity real estate, with institutional backing including endowment, pension, foundation LPs from US, Canada & Western Europe. II. Firm holds jurisdictional and legal advantages that allow stronger downside protection and above market risk-adjusted performance III. Federal lands in urban centers. No municipal or provincial regulation or tax. IV. Housing,mixed use, commercial purpose built rental

Founded: 2014

Founded: 2014Tech-Driven Private Credit for Financial Inclusion and Sustainability in Emerging Markets

Lendable is a leading private credit provider that specializes in structured and senior secured debt solutions to digitally enabled financial inclusion providers and sustainable finance companies across emerging and frontier markets. Lendable's capital enables borrowers to deliver vital financial services and products to underserved populations, fostering financial inclusion, improving livelihoods and emissions reductions. Lendable's propriety technology, Maestro, is central to its approach, leveraging end-customer level data for comprehensive portfolio visibility and impact measurement.

Founded: 2021

Founded: 2021Empowering Latin America's Climate Tech Entrepreneurs

Savia Ventures is a Latam-based impact investing VC firm, seeking to capitalize on the huge market opportunity in LatAm´s climate tech startup sector.

.png&w=640&q=75) Founded: 2016

Founded: 2016Venture Fund

Oxonian Ventures is a group of Oxford-educated investors with the common interest of investing in Oxford educated entrepreneurs. Oxonian Ventures collaborates closely with Oxford affiliated organisations, including the Oxford Entrepreneurs Network, a global community of thousands of Oxonians.

.png&w=640&q=75) Founded: 2023

Founded: 2023We are a gender lens fund investing in the future of finance, climate, and work in Africa

WEAV Capital is a VC fund that is leading investment rounds in gender smart businesses that are spearheading innovation in the future of finance, climate and work in Africa.

Founded: 2023

Founded: 2023Emerging Market Private Credit Investor Enabling Green and Inclusive Growth

Impactable provides institutional investors with attractive exposure to Emerging Markets. Our financial-first, impact-driven approach is designed to scale capital participation where it is most needed. We combine institutional rigour with impact integrity, enabling investors to capitalize on EM growth, drive impact, and achieve competitive returns. Impactable's Private Credit Fund invests in a portfolio of Senior Secured Debt in SMEs and NBFIs across Africa, Asia and LatAm. Growth debt investment strategy, supporting green and financially-inclusive growth.

Founded: 2024

Founded: 2024An impact-focused private credit fund that lends to profitable SMEs, with a gender lens

Sayuni Capital is a women-led, impact-focused private credit fund that lends to profitable small and medium businesses in Kenya and Tanzania, owned by women and local entrepreneurs. Sayuni invests in businesses operating in agribusiness, manufacturing, logistics and trade (the consumer value chain), areas where we see tremendous potential for job creation and inclusive, resilient economic growth. In addition to providing capital, Sayuni provides value-add support to the companies to drive their maturity and professionalization. We provide funding for working capital, asset finance and growth, for companies in the "missing middle": too large for microfinance, but yet too small for institutional capital. Sayuni’s mission is to promote inclusive economies in Africa by providing capital to underfunded companies, further professionalizing the companies, and creating quality jobs.

Founded: 2021

Founded: 2021Inua is a gender-lens fund manager in Uganda

Inua Capital is a gender-lens fund manager which manages impact investment funds that invest patient and flexible risk capital in local Ugandan SMEs across all sectors, with the explicit intention of creating decent jobs and driving sustainable economic development. The word ‘Inua’ means ‘to uplift’ in Kiswahili – it speaks to our core purpose of driving economic transformation. Our vision is just 5 words: to uplift Uganda, our home. We invest local and foreign resources to build an economically, socially and ecologically sustainable Uganda. In a country grappling with poverty and underdevelopment, we champion entrepreneurship as a force to create decent and sustainable jobs. We invest for good growth and thus have a 3-pronged approach to impact: economic empowerment, inclusivity and sustainability. As a fund manager, Inua deploys a flagship growth equity fund that is an evergreen fund investing across all sectors of the economy, but with priority given to those sectors that help further our sustainable development goals, for a modest commercial return. We also manage smaller concessional funding vehicles that, with blended financing, enable us to support and accelerate sectors and enterprises that may not be able to afford commercial capital but that have an extremely high impact on course-correcting our economy’s structure (in line with our 3 lenses). We are also seeking to raise a private credit fund, which will provide concessional capital to focus on accelerating investment in our human development sectors – health and education – which are increasingly strained and underserved in Uganda.

Belle Farm is a sustainable neighborhood near Madison, WI focused on physical and mental wellbeing and a deep respect for the earth. All homes at Belle Farm have solar, geothermal HVAC, and deep-rooted native plants.

Founded: 2023

Founded: 2023Mobilizing Climate Capital to Strengthen Under-Resourced Communities Nationwide

Justice Climate Fund (JCF) is a national nonprofit mobilizing climate capital to strengthen under-resourced communities across America—from rural towns to urban neighborhoods—where opportunity, infrastructure, and investment have historically been limited. Through our “Invest. Empower. Amplify.” strategy, we deliver clean energy solutions that reduce pollution, lower utility costs, and drive long-term social, environmental, and economic benefits. Partnering with a national network of community lenders, and local stakeholders, JCF creates sustainable, scalable solutions that expand access to affordable housing, support small businesses, strengthen local workforces, and enhance financial resilience, bridging critical gaps and amplifying the broader ecosystem of climate and clean energy finance.

Founded: 2013

Founded: 2013VC fund investing in innovators transforming education for the age of AI

LearnLaunch has a family of early-stage VC funds dedicated to empowering diverse entrepreneurs on a mission to drive equity, access, and outcomes in education and workforce upskilling. We are currently raising capital for LearnLaunch Fund III. We target both positive social impact and market-rate returns. Our goal is to invest in a portfolio of 25 pre-seed stage companies that use cutting-edge technology and human-centered design to enable future proof learning, earning and collaboration. Since 2013, we have invested in 91 companies, and of which 66% are run by female and/or BIPOC entrepreneurs. Our combined portfolio reached over 57M learners globally.

Founded: 1998

Founded: 1998Physician-Founded Healthcare Buyout Investor Focused on Underserved Communities in the USA

Based in Dallas and Nashville, Pharos Capital Group is a physician-founded investment firm focused on growing healthcare companies that aim to lower the total cost of care, improve patient outcomes and expand access to care within underserved communities. Since inception, Pharos has invested in 61 companies and has $900 million of private equity assets under management as of June 30, 2025. Pharos typically invests $25-$50 million in rapidly growing middle market companies seeking later stage funding for internal growth, acquisitions, leveraged buyouts, management buyouts, or recapitalizations, predominantly across healthcare sectors. For more information on Pharos, please visit www.pharosfunds.com or visit us on LinkedIn at https://www.linkedin.com/company/pharos-capital-group.

Founded: 1954

Founded: 1954International Alliance for Sexual and Reproductive Health, Rights and Justice.

Fòs Feminista is an international alliance for sexual and reproductive health, rights, and justice working with over 170 partners across 40 countries of the Global South. Our partners, some of whom have collaborated with Fòs Feminista for 70+ years, are typically local healthcare providers and community-based educators working at a national level through a network of static clinics, rural outposts and/or community health workers. These organizations (primarily civil society NGOs) focus on offering high-quality accessible care to women and girls in underserved communities, including maternal care, primary care, and specializations such as cancer, infectious diseases, and gender-based violence. In 2024, Fòs Feminista partner organizations collectively provided 21.3M health services to 3.8M people. Fòs Feminista accompanies, resources, and connects these partners to strengthen local and regional ecosystems that expand health services and related education. Fòs Feminista then serves as a field catalyst to enable innovative interventions, strengthen local organizations’ sustainability, and replicate and scale successful models within national and regional contexts, including our programmatic Feminist Impact Fund which deploys low-interest loans to our partner organizations, and our Innovation and Social Enterprise Lab which provides catalytic grant funding and technical accompaniment to help our partners cultivate and grow earned income models that amplify access to sexual and reproductive health to women, girls, and gender diverse people.

Founded: 2016

Founded: 2016Empowering Africa’s Agricultural and Food Industries to Thrive in Global Markets

Founded in 2016, Farmties began as an initiative to provide market access to smallholder farmers. Over time, we recognized broader challenges—a lack of access to capital, operational inefficiencies, and limited mentorship opportunities. Today, we address these gaps by driving impact-focused investments in agribusinesses, with an emphasis on trade facilitation, gender inclusion, and sustainable practices.

Our mission is to empower native communities by providing accessible, affordable capital

Turtle Island Community Capital was founded in 2024 by Alexander Sterling and Eric Grey Cloud in response to the recognition of the need for development, capacity building and access to good capital in our home communities. Following the NCN conference in DC and with support from Oweesta, Native American Bank, SCORE and NDN collective, TICC is currently seeking investment in operating funds and capitalization funds to begin deploying our initial loan portfolio and start on the road to CDFI certification. We aim to drive long-term community revitalization by supporting clean energy, the blue-green economy, small business development, and infrastructure projects in underserved tribal regions and LIDAC zones. By leveraging strategic partnerships, financial products, and culturally informed approaches, we seek to build financial capacity, create generational wealth, and enhance the quality of life in Native and historically underserved communities.

Founded: 2014

Founded: 2014We are a public benefit corporation that provides education financing (loans and scholarships) to high-promise international students to further their academic aspirations in the USA and Canada.

MPOWER Financing offers education financing (loans and scholarships) to high-promise students from around the world to further their academic aspirations. We believe socio-economic mobility should be borderless. As of 2025, MPOWER has approved over US$2 billion in student loans for more than 40,000 students worldwide.

Founded: 2015

Founded: 2015Building a future where opportunity and economic mobility are within reach for everyone.

We empower tech driven founders tackling the hardest social issues and ensuring impact by centering the views of those most affected.

Blue Impact is launching a $20M fund to back early stage supply chain companies in the US that are optimizing and decarbonizing the supply chain leveraging a Supply Chain Advisory Board of industry LPs and a ~2X MOIC.

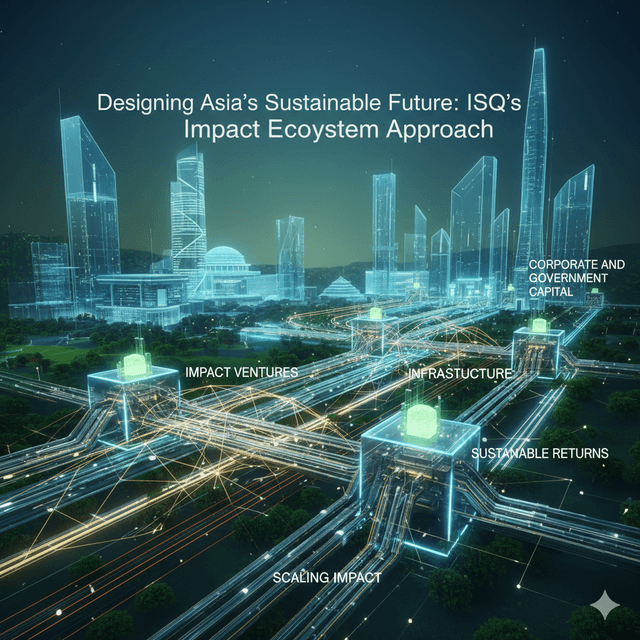

ISQ leverages corporate and government capital to scale impact ventures, lead systemic agendas, and build infrastructure — creating resilient ecosystems that generate both social impact and sustainable returns.

Impact Square addresses Asia's impact investment ecosystem challenges through our First Investor strategy. We welcome any collaboration opportunities for fund formation in the Asian region.

We grow businesses that help nature recover and thrive. The HIVE facility provides venture-building support and catalytic capital to companies that protect critical ecosystems and biodiversity across Southeast Asia .

.png&w=640&q=75) Founded: 2016

Founded: 2016Venture Fund

Oxonian Ventures is a group of Oxford-educated investors with the common interest of investing in Oxford educated entrepreneurs. Oxonian Ventures collaborates closely with Oxford affiliated organisations, including the Oxford Entrepreneurs Network, a global community of thousands of Oxonians.

Founded: 2021

Founded: 2021Empowering Latin America's Climate Tech Entrepreneurs

Savia Ventures is a Latam-based impact investing VC firm, seeking to capitalize on the huge market opportunity in LatAm´s climate tech startup sector.

Founded: 2025

Founded: 2025Expanding racial and gender equity by reducing bias in the capital markets.

Terratai is Asia’s first venture builder for nature, designed to create and support innovative, impactful, and scalable businesses that are tackling the systemic food system challenges driving nature and biodiversity loss in Asia.

Terratai is designed to grow early-stage ventures into sustainable companies that can help nature to recover and thrive. Drawing on our deep familiarity with the Asian venture landscape, we identify and scale high-potential businesses tackling the challenges that drive ecological and biodiversity loss. Our nature impact first strategy provides high potential early-stage companies in Southeast Asia with a combination of access to finance, tailored, long-term venture building expertise, and deep expertise on nature-based solutions.

Founded: 2014

Founded: 2014Tech-Driven Private Credit for Financial Inclusion and Sustainability in Emerging Markets

Lendable is a leading private credit provider that specializes in structured and senior secured debt solutions to digitally enabled financial inclusion providers and sustainable finance companies across emerging and frontier markets. Lendable's capital enables borrowers to deliver vital financial services and products to underserved populations, fostering financial inclusion, improving livelihoods and emissions reductions. Lendable's propriety technology, Maestro, is central to its approach, leveraging end-customer level data for comprehensive portfolio visibility and impact measurement.

Founded: 2000

Founded: 2000We are a leading impact fund focused on access to capital for underserved communities and quality jobs

HCAP Partners is a Southern California-based provider of acquisition and growth capital to lower middle market companies throughout the United States. Established with a vision to stimulate the economic well-being of communities while seeking to generate above-market rate returns, HCAP has been recognized as a leader in the area of debt and equity impact funds.

Founded:

Founded:  Founded: 2021

Founded: 2021Investments in climate and nature

Established in 2010 in Zürich, Clarmondial is an independent advisory firm focused on promoting the sustainable management of natural resources. We combine experience and an extensive network with an independent, flexible and creative approach. This allows us to connect opportunities that deliver social and environmental impact with relevant funders, ranging from donors to mainstream investors.

.png&w=640&q=75) Founded: 2023

Founded: 2023Early stage venture capital firm investing to shape a more beautiful future.

VC 414 is an early stage venture capital firm that invests in underdogs and outsiders who are shaping a more beautiful future - one defined by human vitality, economic abundance, and resilient communities.

Founded: 2017

Founded: 2017Catalyzing Economic Justice Through Responsible Supply Chain Innovation

Founded: 2023

Founded: 2023A catalytic fund to support U.S. natural fiber and textile producers and processors.

The Fibers Fund is a catalytic fund to support small U.S. natural fiber and textile producers and processors, with a specific focus on environmental equity. Sustainable Agriculture and Food Systems Funders (SAFSF) and Fibershed established the Integrated Capital Fibers Fund to facilitate the investment of financial capital into a regenerative U.S. natural fibers and textile industry. The Fund is a direct response to the specific capital gaps identified in the SAFSF Fibers Roadmap Report and through the Fibershed Regional Fiber Manufacturing Initiative.

Founded: 2009

Founded: 2009Global impact investor, focused on financial inclusion, sustainable agriculture and water.

Incofin Investment Management is an impact investment firm dedicated to driving positive change in emerging markets. We focus on three key areas: financial inclusion, the agri-food value chain, and access to safe water. Our mission is to empower entrepreneurs and businesses that are improving the lives of underserved communities. As an AIFM licensed fund manager, Incofin manages and advises on over USD 1 billion in assets, balancing financial returns with meaningful social impact. We prioritize investments in organizations that demonstrate a real, measurable improvement in the quality of life for their clients and staff. With a team of 90+ professionals operating from our headquarters in Belgium and regional offices in Colombia, India, and Kenya, we are deeply committed to fostering sustainable progress where it's needed most. Our investments are carefully selected for their ability to create long-term positive outcomes, ensuring that we support institutions making a genuine difference in the lives of those they serve.

Founded: 2007

Founded: 2007Investing in Africa's Future

AHL Venture Partners is an investment advisor to the AHL Charitable Foundation, the impact strategy for a single-family office. We are focused on driving inclusive economic growth in Africa, by mobilizing significant private capital into commercially scalable and impactful businesses. We invest in the best teams and business models, with significant market opportunity to reach scale, in Climate Action, Financial inclusion and Food & Agricultural sectors, that can generate returns, impact and a demonstration effect for the market.

Founded: 2017

Founded: 2017We are a non-profit organization launching a Venture Fund

CIV:LAB catalyzes locally-led responses to global challenges, namely the climate crisis. We believe that the cross pollination of thought and action across sectoral silos is the only way to devise and grow the impact of urgently needed solutions. We enable this through: Bringing together and facilitating the collaboration of local leaders to grow community-centered climate and developmental initiatives Strengthening the cohesion of local ecosystems of actors through grantmaking, studios, events and strategic convenings

Founded: 2011

Founded: 2011Backing mission-driven founders building the “Better Economy”

Better Ventures is a pre-seed and seed-stage firm backing mission-driven founders building the “Better Economy”—a more sustainable, healthy, and equitable future. With a deep thematic focus, we partner with technical founders leveraging AI and science to transform big industries and deliver outsized impact.

Founded: 2024

Founded: 2024Modernizing small business lending through behavioral science and data intelligence

GoodBread is a next-generation small business lending platform that combines behavioral science with data-driven underwriting to better serve entrepreneurs often overlooked by traditional finance. By analyzing real-time cash flow and individual context, GoodBread offers fair, sustainable credit that aligns with a business’s capacity to grow. The platform enables fast, transparent decisions and integrates technology that can scale nationally. Founded by experienced investors and operators, GoodBread is building both a lending business and a valuable financial technology platform for the future of Main Street finance.

Founded: 2021

Founded: 2021Providing Access to the Next Billion

A pan-African venture capital fund investing in early stage companies providing scalable access to demand-driven products and services. With strong local presence and global networks, the firm has already invested $15 million in seven companies solving Africa’s most pressing challenges in energy, e-mobility, credit, savings, telecom, and agriculture. Our investment thesis is tailored to African realities and requirements. Already 100 million people benefit from our portfolio companies' services and will reach 1 billion by the fund close.

.png&w=640&q=75) Founded: 2021

Founded: 2021We are a top-performing early-stage impact venture capital fund

Triple Impact Capital is an early-stage VC firm that believes that founders addressing the most pressing challenges of today, will build the most valuable companies of tomorrow. The firm invests in three main areas, all of which are being transformed by AI: Healthtech, Sustainable Innovation and Economic Opportunity. The firm's principals have invested in a combined 150 startup companies from the seed stage and have a track record of picking unicorn category winners. They respectively spun out of the most active early-stage venture fund in New York City and a publicly-traded investment firm. To date, the firm has exhibited a track record of success: 1. Fund I performance: Ranked in the top 5% of venture firms in its 2021 vintage year for TVPI and IRR 2. Two exits: First completed in Q4 2024 with proceeds distributed to LPs. Second was a stock transaction. Since forming the fund, they have executed over 50 transactions 3. Portfolio Momentum: Exciting pre-seed investments include companies like Camber (behavioral health SaaS, Series B led by Andreessen), Bandana (hourly worker job platform, Series Seed led by General Catalyst) and Berry Street Health (tele-dietician platform, Series B led by Northzone) 4. Pre-Fund I performance: On-thesis portfolio includes 2 unicorns and is marked at a 9.3x multiple on invested capital 5. Top Tier Co-Investors: Invested prior to and alongside leading global VC funds, such as Andreessen Horowitz, General Catalyst, Founder Collective, and Khosla (early backers of companies such as Facebook, Airbnb, and Uber) Based on the success of Fund I, the firm is now executing the same strategy with their Fund II. They have already completed their first Fund II close and made their first two investments, both of which have already been marked up - with one company accelerating from zero to $15M in annualized revenue in just over a year.

Founded: 2020

Founded: 2020Platform investing in and supporting emerging managers in VC

Recast Capital is platform that invests in and supports emerging fund managers in Venture Capital.

Belle Farm is a sustainable neighborhood near Madison, WI focused on physical and mental wellbeing and a deep respect for the earth. All homes at Belle Farm have solar, geothermal HVAC, and deep-rooted native plants.

Founded: 2024

Founded: 2024Impact investment group focused on regenerative capital and creating more pathways to ownership for underinvested communities

Project Wellspring is an economic development and investment group committed to building lasting wealth in underinvested communities. Our investment thesis centers on ownership as the foundation of economic power. By mobilizing both philanthropic and private capital, we direct resources into catalytic projects including place-based investments—unlocking dormant donor-advised fund assets, backing community-driven enterprises, and creating pathways for broad-based ownership across real estate, business, culture, and innovation.